Our business model is fuelled by a stable and scalable funding and liquidity profile. Our strong and predominantly retail deposit funded balance sheet is supplemented with wholesale funding. Backed by supportive investors, our strong equity position is further strengthened by our ability to issue debt instruments and securitise selected assets for funding and capital optimisation purposes.

Explore Investor Relations

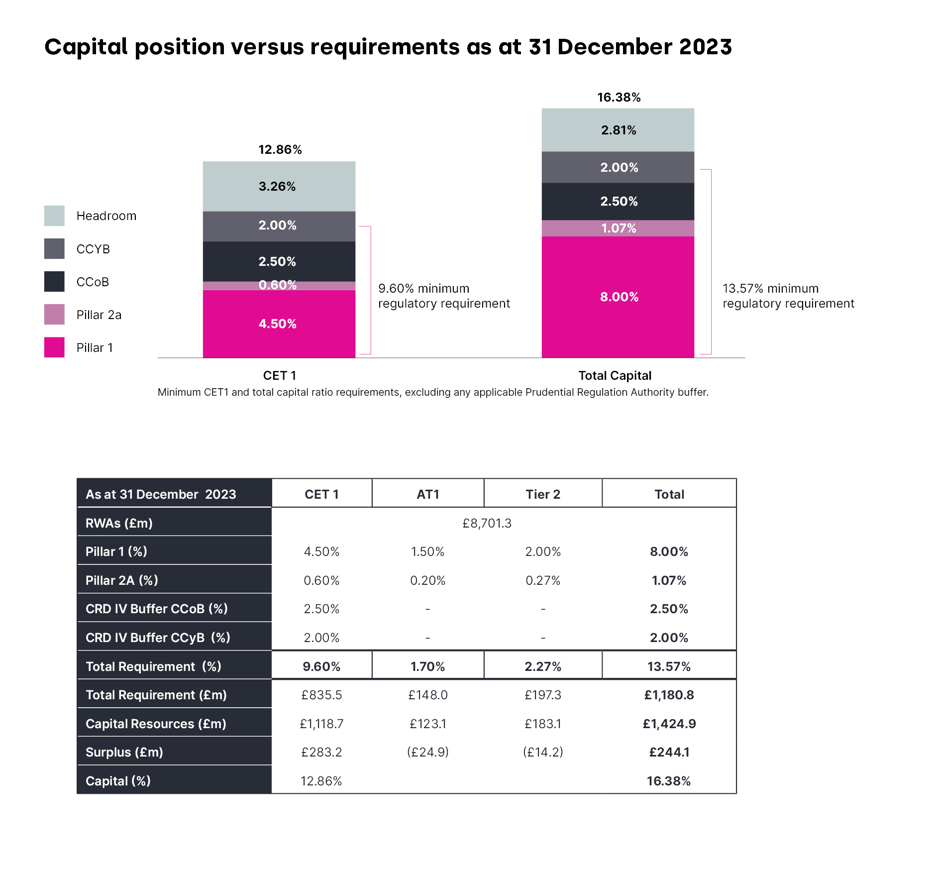

Capital position

The Group remains well capitalised and comfortably above regulatory requirements.

Capital position versus requirements as at 31 December 2023

Capital markets activity

We continue to optimise our capital resources and strengthen our diversified capital and liquidity base through activity in the wholesale markets.

Securitisations

Shawbrook is a repeat lender in the securitisation market, with 8 RMBS deals completed to date:

Residential Mortgage Backed Securities (RMBS) – November 2023

Shawbrook Bank Limited has today, 21 November 2023, announced the successful completion of its Lanebrook Mortgage Transaction 2023-1. The £401m transaction (£405m including excess spread notes) represents the fourth securitisation of Shawbrook-funded buy-to-let loans originated and serviced by The Mortgage Lender (TML) under the Lanebrook shelf, and our third transaction to carry the Simple, Transparent and Standardised (STS) label. The £200m Class A1 tranche, which has a weighted average life just under 3 years, priced at 118 bps above Sonia on the back of strong investor demand, with all other tranches being retained.

The securitised pool is comprised of 2,255 buy-to-let mortgage loans secured against properties in England, Wales and Scotland. The transaction will support the Group’s targeted growth trajectory, funding strategy and capital management.

The links below reference all transactions to date: SMF 2019-1, LMT 2020-1, LMT 2021-1, EMF 2022-1, LMT 2022-1, SMF 2022-1, HMT 2023-1 and LMT 2023-1.

Investor reporting is provided by Citibank (https://sf.citidirect.com/).

Loan-level data in BoE/UK Securitisation Regulation formats along with cash-flow modelling is provided by EuroABS (www.euroabs.com).

Loan-level data (for LMT 2021-1, EMF 2022-1, LMT 2022-1, SMF 2022-1, HMT 2023-1 and LMT 2023-1 only) in EU Securitisation Regulation format along with cash-flow modelling is provided by SR Website (www.secrep.eu).

Residential Mortgage Backed Securities (RMBS) – June 2023

Shawbrook Bank Limited has today, 29 June 2023, announced the successful completion of its Holbrook Mortgage Transaction 2023-1. The £678m fully retained transaction represents the first securitisation of Shawbrook-funded owner-occupied loans originated by The Mortgage Lender (‘TML’), and is the seventh securitisation Shawbrook has completed to date.

The pool is comprised of 3,577 owner-occupied mortgage loans secured against properties in England, Wales and Scotland. The transaction will support the Group’s targeted growth trajectory, funding strategy and capital management.

The links below reference all transactions to date: SMF 2019-1, LMT 2020-1, LMT 2021-1, EMF 2022-1, LMT 2022-1, SMF 2022-1 and HMT 2023-1.

Investor reporting is provided by Citibank (https://sf.citidirect.com/)

Loan-level data in BoE/UK Securitisation Regulation formats along with cash-flow modelling is provided by EuroABS (www.euroabs.com)

Loan-level data (for LMT 2021-1, EMF 2022-1, LMT 2022-1, SMF 2022-1 and HMT 2023-1 only) in EU Securitisation Regulation format along with cash-flow modelling is provided by SR Website (www.secrep.eu)

Residential Mortgage Backed Securities (RMBS) – Dec 2022

Shawbrook Bank Limited has today announced the successful completion of Shawbrook Mortgage Funding 2022-1, a £574m fully retained securitisation. The transaction represents the second securitisation of Shawbrook originated loans, following its inaugural SMF 2019-1 transaction in June 2019, and is the sixth securitisation Shawbrook has completed in recent years.

The pool is comprised of 2,096 buy-to-let mortgage loans which were originated by Shawbrook and are secured against properties in England, Wales and Scotland. The transaction will provide the Group with an additional layer of funding to support its focused growth ambitions, while helping to further diversify the Group’s funding base.

The links below reference all transactions: SMF 2019-1, LMT 2020-1, LMT 2021-1, EMF 2022-1, LMT 2022-1 and SMF 2022-1.

Investor reporting is provided by Citibank (https://sf.citidirect.com/)

Loan-level data in BoE/UK Securitisation Regulation formats along with cash-flow modelling is provided by EuroABS (www.euroabs.com)

Loan-level data (for LMT 2021-1, EMF 2022-1, LMT 2022-1 and SMF 2022-1 only) in EU Securitisation Regulation format along with cash-flow modelling is provided by SR Website (www.secrep.eu)

Residential Mortgage Backed Securities (RMBS) – Oct 2022

Shawbrook Bank Limited has today announced the successful completion of its Lanebrook Mortgage Transaction 2022-1, a £346m fully retained securitisation of The Mortgage Lender Limited (‘TML’) originated loans. The transaction represents the fifth securitisation Shawbrook has completed, following its inaugural SMF 2019-1 transaction in June 2019.

The pool is comprised of 2,452 buy-to-let mortgage loans which were originated by TML and are secured against properties in England, Wales and Scotland. This transaction will provide the Group with an additional layer of funding to support its focused growth ambitions, while helping to further diversify the Group’s funding base.

The links below reference all transactions: SMF 2019-1, LMT 2020-1, LMT 2021-1, EMF 2022-1 and LMT 2022-1.

Investor reporting is provided by Citibank (https://sf.citidirect.com/)

Loan-level data in BoE/UK Securitisation Regulation formats along with cash-flow modelling is provided by EuroABS (www.euroabs.com)

Loan-level data (for LMT 2021-1, EMF 2022-1 and LMT 2022-1 only) in EU Securitisation Regulation format along with cash-flow modelling is provided by SR Website (www.secrep.eu)

Residential Mortgage Backed Securities (RMBS) – June 2022

Shawbrook Bank Limited has announced the successful completion of its £352m fully retained securitisation of Bluestone Mortgages Limited (‘Bluestone’) originated loans. The transaction represents the fourth securitisation Shawbrook has completed in recent years, following SMF 2019-1 in June 2019, LMT 2020-1 in September 2020 and LMT 2021-1 in September 2021.

The pool is comprised of 2,094 owner occupied and buy-to-let mortgages, which are secured against properties in England, Wales and Scotland and were originated by Bluestone. This is the inaugural securitisation of mortgages originated by Bluestone, and the transaction will support the Group’s growth objectives, funding strategy and capital management.

The links below reference all transactions: SMF 2019-1, LMT 2020-1, LMT 2021-1 and EMF 2022-1.

Investor reporting is provided by Citibank (https://sf.citidirect.com/)

Loan-level data in BoE/UK Securitisation Regulation formats along with cash-flow modelling is provided by EuroABS (www.euroabs.com)

Loan-level data (for LMT 2021-1 and EMF 2022-1 only) in EU Securitisation Regulation format along with cash-flow modelling is provided by SR Website (www.secrep.eu)

Residential Mortgage Backed Securities (RMBS) – Sept 2021

The UK’s Specialist Lender of Choice, Shawbrook Bank Limited, has announced the successful completion of its £343m securitisation of The Mortgage Lender (‘TML’) originated loans. The transaction represents the third securitisation Shawbrook has completed in the last two and half years, following SMF 2019-1 in June 2019 and LMT 2020-1 in September 2020.

The £301m class A notes priced at 65 bps above Sonia and were distributed via Lloyds Bank, BoA and Barclays Bank. The margin on the class A notes matches the lowest margin achieved on a UK BTL transaction since the global financial crisis.

The transaction was publicly marketed and as a result of a strong order book we were able to price the deal on 9th September with the A to X2 notes and the residual certificates fully placed aside from £50m of class A notes which were retained.

The pool is comprised of 2,352 buy-to-let (‘BTL’) mortgages which are secured against properties in England, Wales and Scotland and were originated by TML. This is the second securitisation of BTL mortgages originated by TML. The transaction will support the Group’s growth objectives, funding strategy and capital management.

The links below reference all transactions: SMF 2019-1, LMT 2020-1 and LMT 2021-1

Investor reporting is provided by Citibank (https://sf.citidirect.com/)

Loan-level data in BoE/UK Securitisation Regulation formats along with cash-flow modelling is provided by EuroABS (www.euroabs.com)

Loan-level data (for LMT 2021-1 only) in EU Securitisation Regulation format along with cash-flow modelling is provided by SR Website (www.secrep.eu)

Residential Mortgage Backed Securities (RMBS) - Sept 2020

Shawbrook Bank completes £330m BTL RMBS Transaction

The UK’s Specialist SME Lender of Choice, Shawbrook Bank Limited, has announced the successful completion of its £330m securitisation of The Mortgage Lender (‘TML’) originated loans. The transaction represents the second securitisation Shawbrook has completed in the last 16 months, following SMF 2019-1 in June 2019.

The £200m class A notes priced at 110 bps above Sonia and were distributed via Lloyds Bank, BoA and Barclays Bank. The transaction was privately marketed to select investors and as a result of a strong order book we were able to announce the deal publicly on 17th September with the A – E notes fully pre-placed, a total of £259m of placed notes in addition to £79m of retained A2 notes. Subsequently, the £7.9m X note and the residual certificates were also placed with investors resulting in the transaction being fully subscribed at pricing.

The pool is comprised of 2,069 buy-to-let (‘BTL’) mortgages which are secured against properties in England, Wales and Scotland and were originated by TML. This is the first securitisation of BTL mortgages originated by TML. The transaction will support the Group’s growth objectives, funding strategy and capital management.

The links below reference both transactions: SMF 2019-1 and LMT 2020-1

Investor reporting is provided by Citibank (https://sf.citidirect.com/)

Loan-level data in BoE/CRA3 formats along with cash-flow modelling is provided by EuroABS (www.euroabs.com).

Residential Mortgage Backed Security (RMBS) - June 2019

Shawbrook Bank has successfully completed its inaugural Residential Mortgage Backed Security (RMBS) issuance. The pool is comprised of first-lien buy-to-let mortgages which are secured against properties in England, Wales and Scotland. The transaction was rated by Moody’s and Standard & Poor’s, for further information details can be found on their websites.

Investor reporting is provided by Citibank (https://sf.citidirect.com/)

Loan-level data in BoE/CRA3 formats along with cash-flow modelling is provided by EuroABS (www.euroabs.com).

General Enquiries:

Shawbrook Bank

Christopher Such

01277 757 160

ir@shawbrook.co.uk

Hybrid Debt Instruments

We continue to proactively manage our optimal capital composition using hybrid debt capital:

Fixed Rate Reset Perpetual Additional Tier 1 Write Down Capital Securities issued October 2022

Shawbrook Group plc announced in October 2022 its invitation to holders of its existing £125 million fixed rate reset perpetual AT1 instrument, to exchange for a new sterling denominated fixed rate reset perpetual AT1 instrument.

As a result of the exchange, Shawbrook Group plc announced the issuance of its £124 million fixed rate reset perpetual AT1 instrument.

Please click here for the Admission Particulars

Please click here for the Trust Deed

Issuance of £20,000,000 6.50% Fixed Rate Reset Callable Subordinated Notes due 2029 (The “Notes”)

Shawbrook Group plc (“Shawbrook” or the “Company”) announced in September 2019 that it has issued £20,000,000 6.50% Fixed Rate Reset Callable Subordinated Notes (the “Notes”). The Notes mature in 2029 but Shawbrook may at its discretion redeem the Notes in 2024.

The Notes will be treated as Tier 2 regulatory capital which will be used to support the continuing growth of the business while maintaining the Board’s target capital ratios.

Application has been made to the Frankfurt Stock Exchange (Wertpapierbörse) for the Notes to be admitted to trading on the Quotation Board segment of the Open Market (Freiverkehr) of the Frankfurt Stock Exchange.

Fixed Rate Reset Callable Subordinated Notes due 2030

Please click here for further information.

Euro Medium Term Note (EMTN) Programme

EMTN Programme for the issue of Senior Notes and Tier 2 Capital Notes

Please click here for the EMTN Base Admission Particulars

Please click here for the Trust Deed

Please click here for the Supplementary Admission Particulars

Issuance of £90,000,000 12.250% Fixed Rate Reset Callable Subordinated Notes due 2034

Please click here to read the Pricing Supplement

Other Information

See below for constitutional and other governance documents:

Shawbrook Group PLC Articles of Association

Please click here for the Group's Articles of Association

Our ESG strategy

Focusing on those areas in which we can deliver the greatest impact

Environment

We want to play our part in enabling a just transition1 to net zero by leveraging our insights and expertise

- Support the climate transition

- Reduce our climate impact

- Embed climate into our business DNA

Social

We want to boost social mobility, champion equality and diversity and create an inclusive environment for all by leveraging our capabilities, networks and people

- Support customers with specialist finance

- Attract and retain the best talent

- Give back to our communities

Governance

We are committed to operating under a robust governance framework which underpins our purpose and serves all of our stakeholders

- Effective Board and management structures

- Maintain robust governance and risk management

- Transparent and accountable disclosures

1 We use the term ‘just transition’ to describe applying a social lens to opportunities and risk arising from the climate transition, with the interests of employees, communities and customers in mind, to ensure it is fair and inclusive for all actors in society.

Our business

Investors

We provide finance to a range of customer segments that value the premium experience, flexibility and certainty we deliver. Our ambition is to deliver for more customers in more markets. We will do this by combining the innovative mindset and agility of a start-up with the scale and financial strength of a large business.

About Shawbrook

Shawbrook provides finance to a wide range of customers who value the premium experience, flexibility and certainly we deliver. We are a purpose-led organisation, with a focus on delivering long-term sustainable value for all our stakeholders.

Sustainability

Our sustainability strategy is designed to create value for our customers, colleagues, communities, suppliers and shareholders, while having a positive impact on society and the wider environment.