Funding for Employee Ownership Trusts

Whether you want to introduce an employee ownership scheme to improve engagement, provide added benefits for your staff or exit the business, we can help you achieve this transfer of ownership.

Our experienced team arrange funding for a wide range of scenarios, including acquisitions, buy-outs and restructures. We work with advisors, accountants, SMEs, sponsors and trusts to create bespoke solutions to support businesses that provide financial stability as they transition to Employee Ownership Trusts (EOT).

What is an Employee Ownership Trust?

An Employee Ownership Trust (EOT) enables exiting owners to transition ownership of a business to their employees, leaving it in experienced hands while also rewarding and motivating the employees who become co-owners.

Eligible employees will indirectly own the business, and will collectively be beneficiaries of the trust, receiving financial benefits that would typically be given to shareholders.

The exiting owners can remain involved with the business (continuing to own up to 49% of the share capital), enabling them to help plan for the future without making any immediate or dramatic changes in management.

Since their introduction by the government in September 2014, EOTs have become an increasingly popular option for exiting owners given the wide range of benefits these can provide to the business, the exiting owner and the employees also.

What are the key benefits of EOTs?

Our funding is available for UK based limited companies with experienced management and employee teams.

How do Employee Ownership Trusts work?

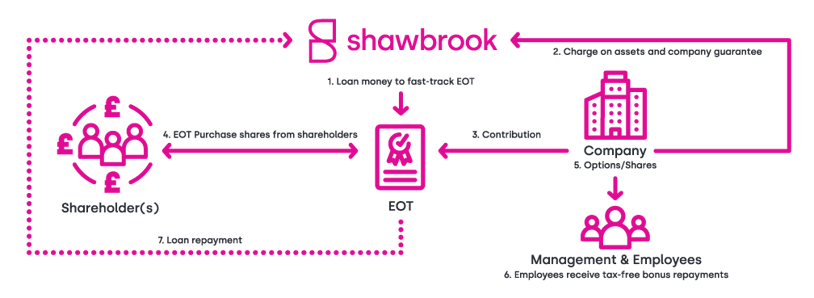

EOT buy-outs are often funded through deferred consideration based on future profitability. This means that shares are sold by the shareholders on a deferred payment basis, with instalments being paid over a period of time. By using external finance, it is possible to speed up access to these funds for the selling shareholders and therefore fast-tracking the EOT.

About Shawbrook

Funding at a glance

Our funding is available for UK based limited companies with experienced management and employee teams.

Releasing value on your assets

Unlock the value tied up in paper and hard assets

For businesses with substantial capital tied up in their balance sheet, our Asset Based Lending proposition can unlock that value to provide both strategic capital and on-going financial headroom to support pivotal events.

Working with capital

Utilising cashflow to fund significant business milestones

A senior debt product designed for established businesses requiring funding for growth, an acquisition, change of ownership or other general corporate purpose. Loan size is determined by a multiple of EBITDA (Earnings Before Interest Tax Depreciation and Amortisation) or vacant possession value of an owner-occupied commercial property, with repayments coming from future cashflows of the business.

Hybrid Solutions

Bespoke senior debt solutions

For businesses we can deliver a holistic financing package combining the best of event driven term debt with the flexibility of working capital solutions.

Supporting the businesses you support

Explore our funding solutions for Private Equity investors supporting UK mid-market SMEs.

Employee Ownership Trust case studies

At Shawbrook we have worked with a number of businesses as they transition to an EOT.

Thinkprint UK transfers to an Employee Ownership Trust

Print marketing solutions provider, Thinkprint UK, has transferred to an Employee Ownership Trust (EOT), enabling a partial exit by its founder and giving employees a voice in the business. Shawbrook’s funding fast-tracked the transition and supported Thinkprint’s technology expansion plans.

Specialist VW Campervan conversion company moves into partial Employee Ownership

Denby Campervans Limited has changed ownership via a sale of equity to an Employee Ownership Trust, in a transaction advised by Yorkshire-based specialist Corporate Finance firm, Castle Square Corporate Finance and funded by Shawbrook.

Staff take ownership of award-winning tax practice

Award-winning tax practice, YesTax has successfully transitioned to an employee ownership trust (EOT) with funding support from Shawbrook. The business has become 100% employee-owned supported by a multi-million-pound Commercial Loan facility.

Adviser or Business Introducer?

We work with a range of corporate debt advisers, accountants, lawyers, and other knowledge based introducers to find solutions for their clients.

If your business is introducing clients to the right partners and we haven't spoken before, we understand that a conversation is just the start.

Useful information

Useful links to more information in case you’ve not quite found what you’re looking for.

Help with our products

If you're an existing customer or you've got questions on how our products work, visit our help centre for support.

Business insights hub

We break down the latest data, insights and topics to help SMEs understand the key issues affecting their business.

News & case studies

Read our latest news and find out more about the businesses we have supported.

Our business

About Shawbrook

Shawbrook provides finance to a wide range of customers who value the premium experience, flexibility and certainty we deliver. We are a purpose-led organisation, with a focus on delivering long-term sustainable value for all our stakeholders.

Sustainability

Our sustainability strategy is designed to create value for our customers, colleagues, communities, suppliers and shareholders, while having a positive impact on society and the wider environment.

Saracens sponsorship

As official banking partner of Saracens Rugby Club, we are proud to champion elite women’s sport by supporting the growth of both women’s rugby and netball as lead sponsor of the Mavericks.